달러 reboot 은 한마디로 말하면 달러가 금본위제로 귀환한다는 애기입니다. 그것두 하루아침에 금가격이 $10,000불로 리셋된다는 애기입니다.

예초에 2018년 1월 1일시작한다고 햇는데 이제는 3.21일로 변경했네요. (

Gold Reset To $10,000/oz Coming “By January 1, 2018” – Rickards

By March 21, 2018,

Donald Trump Could “Reboot” the U.S. Dollar)

짐 리카즈의 발언은 3.1일 시작한다는 SDR Bonds 와 같은 발언입니다. SDR Bonds 과련 최근 나온 기사보니 7.1일로 또 변경했네요.

짐 리카즈의 발언은 너무나 쇼킹한 내용이 많습니다. 게다가 날자까지 픽스해서 언급하는것을 보면 이 분은 좀 허풍이 심한 상태입니다.

그러나 이분의 주장은 나름 큰 의미와 증거를 제시합니다. 즉 상당부분은 실현 가능성이 높은 내용들입니다. 그러니 열린마음으로 이 분의 주장을 한번 리뷰해보시길.

짐 리카즈가 한 발언중 사실 SDR Bonds 라든가 달러 reboot은 각기 달러의 미래에 관련되서 격돌하는 양 극단입니다. 즉 내셔널리스트랑 글로발리스트간에 격돌입니다. 한쪽은 달러를 버리려는 쪽이고 한쪽은 달러를 수호하려는 세력입니다.

달러가 어느쪽으로 가든지 간에 금은의 대급등은 분명한 사실입니다.

내용이 너무 많아 번역은 포기 했습니다. 그냥 그런 주장이 나오고 있다는 거랑, 지금 상황이 영 극단에 근접했다는 것만 주지하시길

원문은 https://pro.agorafinancial.com/p/AWN_dollarreboot_0717/EAWNT864/Full 에 있습니다

====================================================

When the President Signs This Secret

Money Deal, One Investment (NOT GOLD)

Could Soar by as Much as 1,000%, Creating Huge

Windfalls for Investors Positioned Correctly Ahead of Time...

Dear Fellow American,

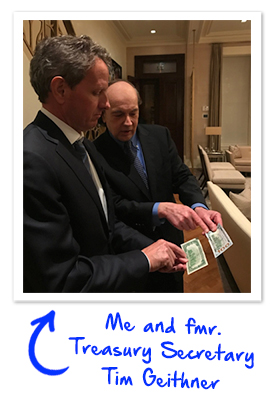

What you’re about to read is the result of information I received during a private dinner that took place one block away from Trump Tower.

The private venue was on West 58th Street in Manhattan, New York City, where seven others and I met.

It was there I met a man who shared information with me that rocked my outlook for the U.S. dollar over the next six months.

In short, my research indicates Donald Trump could be planning a radical “reboot” of the U.S. dollar.

You’ll see why in just a second…

Not only do I believe this is coming… but I believe I know when it’s going to happen, too…

By March 21,2018.

Now, we don’t know it will happen by then for sure… it could happen a little bit earlier or later based on how it all unfolds… but I anticipate it could happen before this date.

That’s why I’m typing this letter to you.

I’ve personally positioned more than $1,000,000 of my own money ahead of this potential “reboot.”

And I want to show you how…

And what you should do with your money, too.

My name’s Jim Rickards, by the way.

And the “reboot” event I’m about to share with you is the culmination of the deep research I’ve done in my three New York Times best-selling books and my life’s work advising the U.S. government.

It was something Ronald Reagan supported as president but couldn’t get accomplished because of political pressures…

But based on a private dinner I just had with a man I call “Mr. Davos,” with connections to some of the world’s most important elites, I’m convinced that Donald Trump can and will get it done.

The key is a secret money deal that Trump could sign in the coming months…

If he does, I’m certain well-positioned investors could make as much as 11 times their money.

It will mark a fundamental shift from the awful Obama years.

In fact, investors who stay stuck in Obama-land are going to face big losses.

More importantly, I believe the dollar “reboot” will happen by March 21, 2018.

But as you’ll see, this could happen much sooner than that. So you’ll need to prepare now.

Your life and the character of America is about to change forever.

But this letter isn’t a breaking news bulletin.

It’s a time-sensitive opportunity you need to act on immediately to reap the benefits.

You see, if Donald Trump signs this new money deal:

The U.S. dollar will “reboot”...

Sending one investment (not gold) soaring as much as 1,000%...

Creating a huge windfall for Americans positioned correctly ahead of time.

Seem unbelievable?

What if I told you President Donald Trump used a similar — but much less significant — monetary deal in the 1980s to make a massive 327% windfall for himself?

It’s true.

It was enough to take every $500,000 he invested…

And turn it into more than $2 million.

He even called it “easier than the construction business.”

But you don’t need millions of dollars to profit this time around…

Or be a real estate mogul…

Or be President of the U.S. to take advantage of the windfalls that come after these monetary accords are made.

You simply need to see the signs that a massive monetary shift is coming (and one is)...

Then, position yourself accordingly.

Trump’s secret money deal would be a massive shift.

A total dollar “reboot.”

And a far bigger opportunity than what Donald Trump profited from decades ago…

I’ve done the math given today’s economic environment. And if you’re positioned properly before this dollar “reboot” is made…

You stand to make as much as 1,000% by the time it’s in effect.

The key isn’t gold… or a stock, bond, currency… or bitcoin…

Yet, if you combine the secret with a few other simple moves, then the way you work… live… raise your family… retire… and enjoy your free time will be radically changed for the better.

I’m personally using over $1,000,000 of my own wealth on these moves to position myself and my family for what’s coming.

You’ve likely never heard the steps I’m going to recommend to you.

Usually, only very low-key, very down-to-earth Americans who are secretly rich know about these moves.

And I’ll share it all with you.

I’ll show you what’s going on behind the scenes in the Trump White House… and what I recommend you do right now because of it.

But I’d consider you crazy if you weren’t asking yourself:

Who am I to know all of this?

Why would Trump’s team talk to me?

And…

How could I possibly know of this possible dollar “reboot” when none of the mainstream media outlets have reported on it?

Let’s back up and take those one by one, starting with who I am…

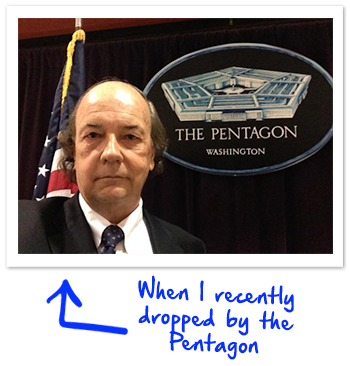

The Government Insider Who’s Advised the Pentagon, Treasury and CIA on the World’s Most Dangerous Financial Threats

I have all the “normal” credibility you’d expect from the deepest political or economic insiders in America.

I’m the author of three New York Times best-selling books —Currency Wars, The Death of Money and The Road to Ruin — warning about the economic threats America faces.

I have a high profile on popular financial TV, print and online media outlets. Turn on the TV and tune into CNBC, Fox, Bloomberg or Russia Today and you’ll likely see me on the channel.

I’m also the authority on the importance of sound money and on fixing today’s monetary system…

That alone is enough for me to speak credibly about this coming dollar “reboot” and the one investment that could soar by at least 1,000% because of it.

Yet, that’s where my similarities with my peers end. Because my credibility reaches far, far deeper than anyone else you know…

My work as a currency war advisor for the Pentagon, CIA and national intelligence brings me into direct contact with the top echelons of the U.S. power structure.

My work as a currency war advisor for the Pentagon, CIA and national intelligence brings me into direct contact with the top echelons of the U.S. power structure.

They’ve given me a top-secret national security clearance, too.

I’ve testified in front of Congress…

I’ve been in the West Wing of the White House on official business multiple times...

I helped in the 1980s negotiation to release U.S. hostages from Iran...

I’ve sat deep in the Treasury Department… stared officials in the face and warned them about crises like 2008 years before it happened. (They ignored me…)

I’ve sat deep in the Treasury Department… stared officials in the face and warned them about crises like 2008 years before it happened. (They ignored me…)

And while I can’t be specific with senior military or politicians’ names or statements, I can tell you they’re preparing for something big.

In one of my most high-profile missions, I helped senior U.S. military strategists at America’s Warfare Analysis Laboratory.

We conducted their first-ever “financial war game” to determine threats against the U.S. dollar.

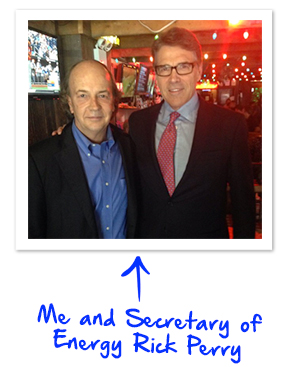

I routinely rub elbows with Federal Reserve board chairs like Ben Bernanke… five-star generals and NSA directors like Michael Hayden... finance ministers of various governments… presidents… prime ministers... Fortune 500 CEOs... and the world’s most powerful investment bankers.

I routinely rub elbows with Federal Reserve board chairs like Ben Bernanke… five-star generals and NSA directors like Michael Hayden... finance ministers of various governments… presidents… prime ministers... Fortune 500 CEOs... and the world’s most powerful investment bankers.

They ask me for my opinions on things just like this potential dollar “reboot” and tell me things they’ll never say publicly.

In fact…

Our firm has been sending password-protected research to a high-level cabinet member within the Trump White House for months now. He’s literally responsible for almost everything the federal government does.

I’m a personal friend with an influential secretary in President Trump’s cabinet...

Not to mention, a member of our research network’s received an email from the man who’s President Trump’s No. 2 in the White House asking for advice on the economy…

Ultimately my connections — like the insider who told me about Trump’s dollar “reboot” — are where I get my best information.

Ultimately my connections — like the insider who told me about Trump’s dollar “reboot” — are where I get my best information.

It’s why I’m confident that by March 21, 2018, Donald J. Trump’s signature on an important agreement will trigger a dollar “reboot.”

And by the time the ink is dry...

One, and one investment alone (you’ve never heard of it, trust me) could shoot up by at least 1,000%.

Obviously, nothing’s guaranteed when you invest. That goes without saying…

But I firmly believe this opportunity is your best chance at these kinds of gains.

The reason’s simple:

Trump Could Soon Give the U.S. Dollar the Biggest “Reboot” in 100+ Years

Before I show you exactly what this dollar reboot is…

When the switch is likely to be flipped…

And how it will “reboot” the dollar and change everything for your life and the life of our nation…

Let me show you WHY President Trump needs to reboot the dollar if America is ever going to be great again.

This is important. And it’ll be key for you to understand why just one investment could soar by at least 1,000%...

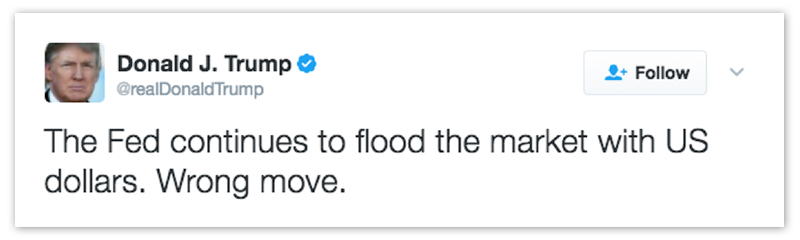

Donald Trump tweeted America’s problem very clearly:

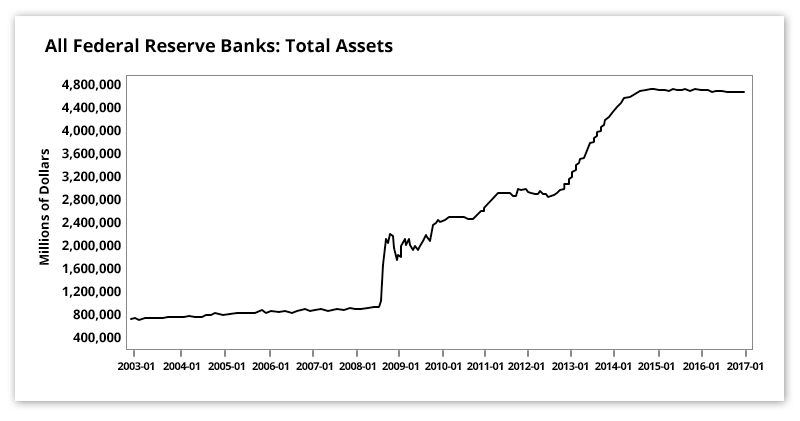

The Federal Reserve — America’s central bank — has lowered interest rates and printed nearly 4 trillion new dollars out of thin air since the economic crisis in 2008.

That’s equivalent to nearly one quarter the size of the entire U.S. economy.

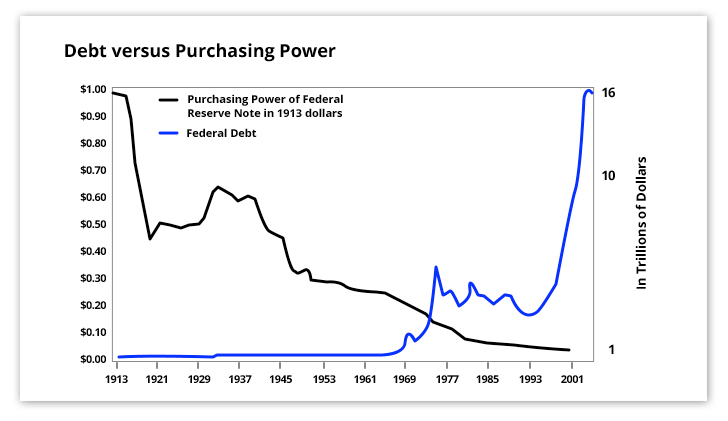

Look at this chart. It shows you the Fed’s flood of new dollars that President Trump was talking about:

Since 2008, many analysts and commentators have feared this chart because they believe it will lead to massive price increases in the economy — or hyperinflation.

But everyday prices haven’t gone into hyperinflation.

In fact, the number one consequence of all of this money printing so far hasn’t been inflation at all…

It’s been debt.

This is likely the #1 reason why Donald Trump’s slogan is: “Make America Great AGAIN.”

Because…

America Has Gone From Great...

to Greatly in Debt!

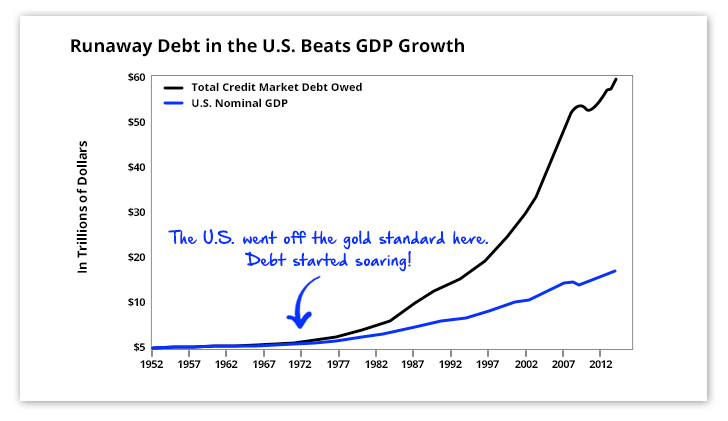

Total U.S. debt — across all private sectors — has risen to nearly $60 TRILLION…

That’s over three times as big as the entire U.S. economy.

If you add the federal debt to that number, you get $80 trillion! That’s more than four times the size of the U.S. economy.

Just look at this chart of total debt in the United States:

In other words, if you and every single American took 100% of your annual income and tried to pay off the national debt for four years straight, we would still have $4 trillion of debt left to pay off!

The problem started in 1971.

That’s when Richard Nixon killed the U.S. gold standard, once and for all. You can see it happen on the chart I just showed you.

As soon as Nixon kills the gold standard in ’71… debt begins to skyrocket!

From that point on, crushing debt, overconsumption, offshoring of American jobs and the ripping off of Main Street by Wall Street took hold.

And since the 2008 crisis these terrifying trends have picked up speed at an alarming rate...

Obama brought our country to the brink of ruin. He added as much federal debt as all presidents before him — from George Washington to Bill Clinton — combined over the entire 220-year history of the United States!

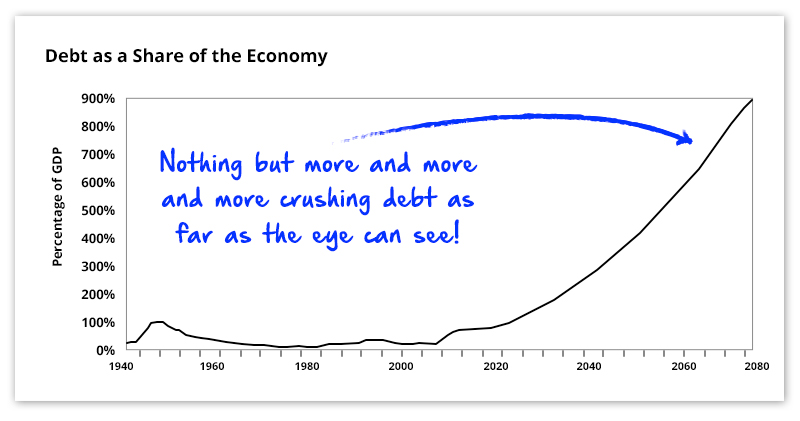

The Office of Management and Budget and the Congressional Budget Office project the debt going as high as 250% of GDP in the years ahead if Trump doesn’t make a change:

In fact, the Government Accountability Office just reported this year that the U.S. is at risk of “fiscal failure.”

And Harvard Economics Professor Kenneth Rogoff says, “There’s no question that the most significant vulnerability… is the soaring government debt. It’s very likely that will trigger the next crisis as governments have been stretched so wide.”

And Investor’s Business Daily reports that: “Current total debt, at roughly 105% of GDP, is already in the danger zone — and based on historical economic studies, this is where nasty things can happen.”

All of this is the result of too much debt… too many Obama policies… and too much meddling by the Federal Reserve.

But America didn’t always have this problem…

The United States used to have a dollar backed by gold.

Back then, the country had far less public and private debt, compared to $80 trillion today.

The government was small, and couldn’t squander your and my tax dollars.

We couldn’t wage endless wars.

There was barely any inflation.

Our money was stable. Our economy was growing.

Simply put, America was great.

And I believe Donald Trump will take an important step...

The Key to Making America Great Again

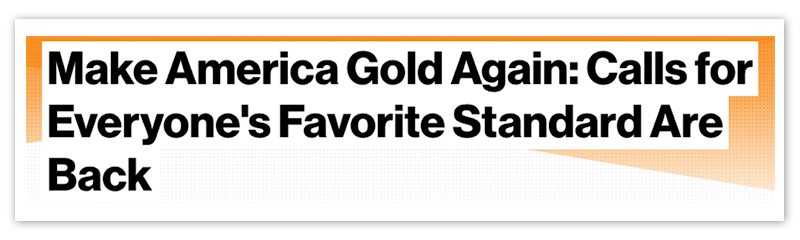

One best-selling economist says, “The gold standard era, defined say as 1815-1913, was arguably the greatest period of human advance ever, at least in matters of economics, culture and technology.”

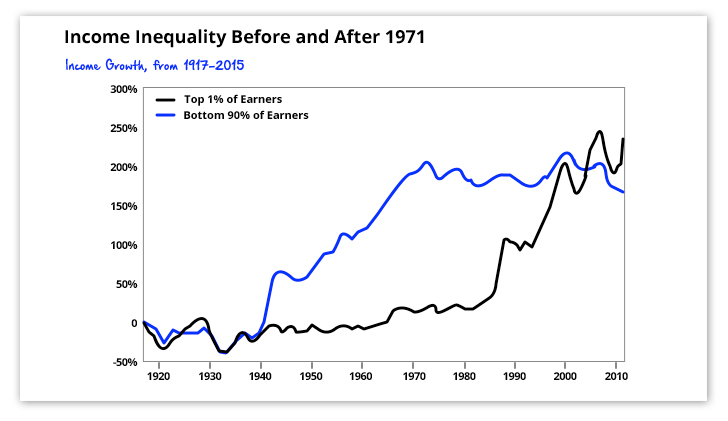

But when we went off the gold standard, hardworking Americans’ income flatlined and the uber-wealthy made all of the economic gains!

Here’s the proof:

Since we’ve gotten off the gold standard, America has declined. The economy’s failed its workers and our nation isn’t respected abroad.

But now we have a huge opportunity to right the ship. Just listen to President Trump in his own words:

(click play button)

This is why one of America’s greatest financiers, John Pierpont Morgan, said, “Gold is money, and nothing else.”

And why President Ronald Reagan warned: “No great nation in history that abandoned the gold standard ever stayed great…”

Reagan wanted to reform the U.S. dollar with his own monetary accord to tie the greenback to gold again.

He even recorded a commercial about it that was buried for 36 years until my research network used our contacts to dig it up and publicly circulate it:

(click play button)

Reagan even tried ordering a Congressional Commission to investigate how a modern gold standard could be set up in America.

But career politicians killed Reagan’s effort right from the beginning.

Yet, after a private dinner near Trump Tower with those close to the situation, I now believe Donald Trump could accomplish what Reagan couldn’t.

A total reboot of the U.S. dollar…

A move that will completely rewrite America’s money rules.

And potentially make well-positioned investors in one particular investment (not gold) as much as 11 times their money...

But time is running very short...

The Dollar Will Die if It’s Not “Rebooted” Immediately...

The U.S. dollar — and by extension, the global economy — is facing an imminent threat.

Obamacare… the Obama debt… Obama’s open borders… Obama’s retreat from the world stage… has all but killed what made America great.

Obama put the interests of America’s retirees… U.S. workers… veterans… and everyone else who used to make up our Middle Class behind the elites.

He helped the big banks… international corporations… and even foreign leaders at the expense of you and me!

That’s why Donald Trump was elected. Voters knew we couldn’t take another four years of Obama if Hillary Clinton won.

And thank goodness we put Trump in office…

Because now President Trump can take steps to avoid disaster.

But he needs to act quickly.

America is in severe danger of going through what physicists call a “phase transition.”

You might call it the “tipping point.”

Here’s a simple illustration.

Picture yourself in a room of 500 people listening to a speech.

Now, imagine four people stood up and immediately ran out of the room very fast.

What would you do?

Probably nothing, right?

You would think they needed the bathroom or got an urgent call or something. But you would probably stay seated.

Now, imagine the same scenario — except that instead of four people, 100 people suddenly get up and run out of the room as fast as they can, all at once.

What would you do then?

I dare say you’d get up and exit the room right behind them!

You’d figure there was a fire or imminent danger that they knew about and you didn’t.

But you wouldn’t stick around to find out.

You’d run for the exits as fast as possible and ask questions later!

The death of the dollar will be no different.

Countries aren’t sticking around to figure out whether the U.S. can really pay back its debt or wait to see if their dollar reserves are going to keep losing their value…

Like billionaire investor Warren Buffett said, “People are right to fear paper money… it’s only going to be worth less and less over time…”

And he’s right. The U.S. dollar has lost 96% of its value since the Federal Reserve was created in 1913. Meanwhile the national debt has skyrocketed!

The dollar and debt are two sides of the same coin:

That’s why many countries are relentlessly abandoning the dollar.

Typically most foreign governments invest their surplus or savings in U.S. financial assets.

Global trade is typically conducted in U.S. dollars, too.

The dollar is what’s called the “world’s reserve currency.”

As one Forbes columnist put it, “ There is a global currency. It’s called the ‘U.S. dollar.’”

But all of that is about to change if the dollar is not rebooted.

The dollar is getting dumped around the globe because of our debt, spending and money printing.

Just look at how we’re being betrayed by our closest allies and attacked by our sworn enemies…

THERE HAVE BEEN $1.4 TRILLION IN ATTACKS ON THE DOLLAR

- The United Kingdom ($18.7 Billion Betrayal):Joined China’s Foreign Exchange Trade System to bypass the U.S. dollar and trade directly in sterling and yuan.

- China ($100 Billion Attack): The Chinese official sector sold almost $100 billion of U.S. stocks over the past year. They've been reducing their Treasury holdings. And they've secretly been stockpiling hundreds of tons of high-purity gold bullion bars.

- Iran ($1.2 Billion Attack): Has used gold to avoid U.S. sanctions and the dollar-based payments system called SWIFT.

- South Africa ($2.5 Billion Attack): Has joined with the BRICS nations to create a bank that will extend at least $2.5 billion so far in 2017 in non-dollar credit to the world.

- Hong Kong Monetary Authority and South Korea ($83 Billion Betrayal): Both have joined and expanded their roles in the CMI, or Chiang Mai Initiative, which is a non-dollar currency swap agreement with the 10 countries that comprise the ASEAN nations, including Indonesia, Cambodia, Brunei, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

- India ($8.2 Billion Betrayal): Has made agreements with Japan to receive yen for internal development projects, instead of turning to U.S. development institutions like the World Bank for dollars or going to the U.S. government itself.

- Japan ($69 Billion Betrayal): Has agreed to circumvent the dollar and trade directly with China in billions worth of yuan and yen. One news outlet says the move aims to “hedge the risk of the dollar’s fall in the long run as the world’s key settlement currency.”

- Switzerland ($24.17 Billion Betrayal): Agreed to help China develop its offshore yuan market so more countries can diversify away from dollars into yuan. According to Bloomberg, the Swiss franc makes “the seventh major currency that can bypass a conversion into the U.S. dollar and be directly exchanged for yuan.”

- Sweden, Norway and Denmark ($2.5 Billion Betrayal): Created a euro currency-beeline to Iceland that doesn’t require dollars.

- South Korea ($20 Billion Betrayal): Has created bilateral currency swap agreements with Australia, China, Malaysia and Indonesia that last until 2020. They’ve renewed a multibillion won-yen currency swap with Japan. And they’re also actively trying to forge a direct currency swap deal with the United Arab Emirates.

- Russia ($7.8 Billion Attack): Is actively recruiting nations to trade oil in rubles instead of dollars and having its largest state-owned oil company issue its corporate debt in Asian currencies instead of privileging dollars. Bloomberg says its “aim is to move away from quoting petroleum in U.S. dollars.”

- United Arab Emirates ($55 Billion Attack):Created a bilateral trade deal with China to trade in dirhams and renminbi. One expert said the Chinese are “trying to shoot for an alternative currency to the dollar.”

- Saudi Arabia ($750 Billion Attack): Threatening to take a $750 billion prop out from under the U.S. dollar if America doesn’t meet its demands.

- The International Monetary Fund’s Betrayal:Added the Chinese yuan to its supranational currency, the Special Drawing Right. One millionaire commodity investor remarked upon the news, saying, “The U.S. dollar is a very flawed currency… [the yuan] will probably challenge the U.S. dollar.”

The total amount of “de-dollarization” is at least: $1.14 TRILLION…

And the list of dollar backstabbers you just read isn’t exhaustive. The true amount of dollar dumping is likely much higher than that.

Now answer me honestly...

Can America ever be “Great Again” if the entire world is avoiding the dollar like the black plague?

Of course it can’t.

From the year 1450 to roughly 1925, from Portugal to the British Empire, the world’s superpowers have risen and fallen on the strength and acceptance of their currencies.

Based on centuries of data analyzed by the president of world markets at a multibillion-dollar bank, the average lifespan for a world reserve currency like the U.S. dollar is a little bit more than 90 years.

And get this: The dollar has been the world reserve’s currency for 91 years!

The clock is ticking and Donald Trump knows it.

He knows he needs to restore confidence in America and the U.S. dollar immediately.

That’s why he needs to “reboot” the dollar ASAP.

And I’ve received an important data point recently — at a private dinner with a man that absolutely no one has ever heard of — that this is in motion.

It helped me confirm that America is on the path I’m telling you about…

This is why I’m so confident that if you position yourself in one specific investment (not gold), you could see at least 1,000% gains as America “Becomes Great Again.”

But it’s not just the “de-dollarization” of the world that’s making this so urgent. You see, countries have not only stopped buying U.S. Treasuries… but they're selling them at a record clip.

Bloomberg reports, “ America’s Biggest Creditors Dump Treasuries in Warning to Trump .”

The Economist says, “As America’s economic supremacy fades, the primacy of the dollar looks unsustainable.”

And Forbes shocked readers, publishing, “U.S. Role in Global Economy Declines Nearly 50%.”

Even Donald Trump himself, before taking the oath of office, made a very public move to dump the dollar in his own business dealings. Watch this newsreel:

(click play button)

Afterwards Trump said:

“It's a sad day when a large property owner starts accepting gold instead of the dollar. The economy is bad, and Obama's not protecting the dollar at all... If I do this, other people are going to start doing it, and maybe we'll see some changes."

Trump understands what’s at stake. Sooner than later, a critical mass of foreign governments and investors will start exiting the dollar.

It will be the point where everyone stampedes out of the crowded room, to continue my earlier analogy.

At that point, the full faith and credit of the U.S. government will evaporate. People will not have trust in the financial system. Our international monetary system built on the dollar, the “money multiplier” and debt will collapse.

The U.S. Treasury Department tells us what to expect at that point:

“[It] would be unprecedented and has the potential to be catastrophic: credit markets could freeze, the value of the dollar could plummet, U.S. interest rates could skyrocket, the negative spillovers could reverberate around the world, and there might be a financial crisis and recession that could echo the events of 2008 or worse.”

I’m confident there is a fix, though.

The key will be a bold new monetary policy by the Trump administration.

The Wall Street Journal published an article confirming this, saying Trump’s real challenge will be the U.S. money system itself.

“The solution,” it said, “lies in monetary policy.”

A total reboot of the U.S. dollar.

One that will reset America’s economy…

And send one unique investment soaring. Every dollar you choose to invest in it could increase as much as 11-fold.

Let me show you what this reboot is right now…

President Trump’s

“Mar-a-Lago Monetary Accord”

I believe President Trump will host an international monetary summit at his “Winter White House” in Florida, the historic Mar-a-Lago resort.

Using his stature as leader of the free world, he’ll bring the financial leaders of the globe together.

This would include delegates from the U.S., China, Japan, Germany, Italy, France, the UK and the International Monetary Fund.

Then, they’ll agree to simultaneously revalue all of their currencies against gold until the price reached $10,000 per ounce. (If you’re skeptical, I’ll give you ironclad proof that this could happen in a second.)

The Federal Reserve board will then call a special board meeting… vote on the new policy… walk outside and announce to the world that effective immediately, the price of gold is $10,000 per ounce.

The Fed will make the $10,000 price stick by using the Treasury’s gold in Fort Knox and the major U.S. bank gold dealers to conduct “open market operations” in gold.

Here’s how that works…

The Federal Reserve will be a gold buyer if the price hits $9,950 per ounce or less and a gold seller if the price hits $10,050 per ounce or higher.

The world’s other central banks will agree to the same.

For mathematical reasons I’ll explain in just a second, gold will need to be $10,000. No more, no less.

This will immediately put an end to the currency wars and the debt-based dollar system.

It will be a one-time “reboot” period that will put the world on solid footing for economic growth for decades to come.

The immediate adjustment would create a massive windfall for gold bullion holders and owners of gold mining shares (though that’s not the true opportunity here).

It would also create a lot of market volatility as people react to the announcement.

Now, I write and speak about $10,000 gold all of the time.

I wrote a New York Times best-seller on the topic.

Most people just roll their eyes.

They assume that $10,000 per ounce is a made-up number, or that I pulled it out of thin air, or I’m just trying to get attention.

None of these things are true.

The $10,000 per ounce number is actually the result of some straightforward mathematics that I’ll show you in just a minute.

It’s the gold price Donald Trump will need to use to “reboot” the U.S. dollar and the world’s international monetary system.

This isn’t a far-fetched concept, by the way…

Since the world financial crisis in 2008, many of the world’s governments have been buying physical gold in record amounts.

In fact, according to a recent report by the Official Monetary and Financial Institutions Forum, world central banks have been buying gold at a rate of 385 tons per year since the 2008 crisis.

Those are levels last seen when the world was on the gold standard pre-1971.

Why are they buying so much gold?

Because they know gold is going to be money again…

And the more gold they own, the more leverage they'll have when Trump calls the world’s financial powers together to reform the monetary system at his Mar-a-Lago resort.

President Trump said it himself:

The good news is the United States and our negotiator, Donald Trump, has the largest gold stash out of any country.

Look:

This means everything is full steam ahead for the “Mar-a-Lago Monetary Accord” and the dollar’s “reboot.”

Even better, according to a recent Gallup Poll, more than twice as many Americans supported returning to gold as money as those who didn’t.

I bet if you took an update poll again today, given the enthusiasm around Trump, you’d get an even better response.

Simply put, there’s no stopping this dollar reboot. Its time has come.

The “Mar-a-Lago Monetary Accord” will be a turning point in American history.

And it could be a turning point for you financially as you reap up to 1,000% from the dollar reboot investment I’ll tell you about in just a minute.

But first, just in case you think this sort of thing can’t happen here…

You should know...

Trump’s Dollar “Reboot” Would Be the 10th Major Reset in the Last 100 Years

Over and over again throughout American history, an old economic order stagnates and needs to be “rebooted.”

One of my close friends, former Deputy Secretary of the Treasury Kenneth W. Dam, refers to these reboots as: “Rewriting the rules of the money game.”

In fact, most people are surprised to know that reboots like the one Donald Trump could be planning have happened NINE TIMES already in history…

They always follow the same pattern…

World leaders hold a summit at a high-profile location that will go down in the history books…

And they “reboot” the rules of the monetary game to stabilize the system and get the world back to economic growth.

This is all well-documented history going back a century:

THE NINE MONETARY “REBOOTS” OF THE PAST CENTURY

The Genoa Accord, May 1922: 34 nations gathered at the Palazzo di San Giorgio in Italy to “reboot” what was called the gold exchange standard and restore the international monetary system.

The Threadneedle Street Accord, 1931: With gold flowing out of the UK, loans from New York and Paris exhausted and a budget crisis underway, the Bank of England decided to abandon the gold standard and devalue the sterling. This “rebooted” the economy and stopped the crisis.

The White House Accord, 1933: Franklin Roosevelt unilaterally creates a two-step plan to try and “reboot” the U.S. economy out of the great depression. First he confiscated the nation’s private gold holdings. Then, he ordered a 60% devaluation of the dollar — moving the price of gold from $20.67 to $35 per ounce.

The Bretton Woods Accord, July 22, 1944: 44 countries and 730 people gathered in New Hampshire to “reboot” the post-WWII monetary system. The dollar was tied to gold at $35 per ounce. And the rest of the world’s currency was tied to the dollar and convertible into gold.

The Smithsonian Accord of December 1971: The “Group of 11” — U.S., UK, Japan, Canada, France, West Germany, Belgium, Netherlands, Italy, Sweden and Switzerland — agreed to “reboot” the dollar by devaluing it by 8%.

The Jeddah Accord in July, 1974: The U.S. was facing an oil crisis… runaway inflation… a crashing stock market and recession. Nixon sent Henry Kissinger and William Simon to Saudi Arabia and rebooted the dollar by creating the “Petrodollar Deal.” This priced oil solely in U.S. dollars in exchange for defending the Saudi royal family with U.S. military might. Since everyone needs oil, everyone needed dollars so they could buy it. This massive new demand for dollars saved the American financial system.

The Plaza Accord , September 22, 1985: Signed at the Plaza Hotel. There, the top financial officials from the United States agreed with the UK, West Germany, France and Japan to reboot the dollar to a lower value to help the world economy.

The Louvre Accord, February 22, 1987: After the Plaza Accord didn’t work out so well, a new accord was signed at the Louvre Museum in Paris to correct the mistakes. The damage was so bad from the Plaza Accord that the group agreed to reboot the dollar once again and halt the dollar’s devaluation.

The Shanghai Accord on February 27, 2016: I was one of the leading researchers trying to sound the alarm on this accord. This was a failed Obama policy. His idea was to purposely weaken the dollar in order to help China from collapsing, because China’s currency is pegged to the dollar. It hasn’t helped the U.S. economy at all. In fact, it’s put it at risk.

The period that followed the Louvre monetary accord in the late 1980s was called the “King Dollar” period.

There was massive economic growth and the United States was the sole superpower — respected around the world.

But today that old deal is stagnating. That’s the reason we need a new dollar reboot.

One Forbes contributor confirmed in writing about the world economy, “People are hoping for a reboot.”

And the intelligence service Stratfor speculates, “The Trump administration may begin considering unorthodox measures.”

Their forecast includes Trump “negotiating a new coordinated monetary intervention” among the world’s powers, “a technique that has fallen out of fashion in the past two decades.”

This is the key to Trump restoring confidence in America and the dollar by instituting a new gold-backed dollar at $10,000 per ounce.

This could reboot the world economy…

Create economic growth and stability...

And even better, it could send one specific investment (not gold) soaring.

And make you 11 times your money if it does.

That’s why I’ve prepared a new strategy to help you reap tens of thousands of dollars in profit from this new Trump Accord that could be coming.

You’re going to want to read it immediately and take action.

But before I show it to you, there has got to be one big question on your mind...

Why would the Federal Reserve or big banks in America ever allow Trump to institute a gold backing to the dollar?

After all, Janet Yellen doesn’t like gold…

And the Fed and big banks benefit from our debt-based system and have huge political power in this country...

That’s a great question.

And normally, I’d agree with you.

But something very different is in play this year. Something I never thought I’d see in my lifetime...

By March 21, President Trump Could Have Total Control Over the Federal Reserve. The First Time for Any President Since 1914

Actually, March 21, 2018, could end up being a conservative date.

Everything I’m explaining could conceivably happen much sooner than I’m explaining here...

President Trump could flip the switch on this dollar “reboot” much sooner than anyone expects.

Of course, I can’t tell you all of these things will happen by March 21 for certain. President Trump’s opinion could change or he could alter his plans.

Maybe events happen as I expected… or later… or earlier…

But that’s why it pays to get positioned for this right now; otherwise the opportunity might pass you by.

That’s because the stars have aligned in a very special way.

You see, there are seven total seats on the Board of Governors of the Federal Reserve. That’s the group that makes our central bank’s decisions.

The president appoints each governor.

And there have been two vacancies on this board throughout President Obama’s presidency.

Those are two Fed governors that Trump now gets to appoint.

But just recently, another governor of the Federal Reserve System, Dan Tarullo, just resigned.

His resignation means there are now three vacancies on the board.

That is the most Federal Reserve seat appointments at one time by any president since Woodrow Wilson in 1914 when he first created the Federal Reserve.

But it gets better…

Of the remaining four governors, one is a Republican — his name’s Jay Powell.

You don’t hear much about him because he’s outnumbered by Democrats right now on the board.

But soon, Powell could be joined by three new Republican appointees that Trump makes.

That will give Republicans a majority of four seats on the Federal Reserve board.

But it gets EVEN better...

In addition, Janet Yellen’s term as chair is up in less than a year, and the vice chairman’s is up soon after...

That means Trump could be able to appoint five governors in the coming months, including a chair and two vice chairs.

Trump will have six out of seven board seats in Republican hands.

In effect, Trump will own the Fed!

The Republicans will also have the White House…

And a majority in the House of Representatives and Senate…

Conservatives will soon be a majority on the Supreme Court, too.

And there are more Republican state legislatures and governors in the state mansions than at any time since Civil War reconstruction.

This means President Trump could have 0 resistance to changing the debt-dollar system we have.

He can conduct a full “audit” of what the Fed does… who makes the decisions there… and steer it to do what he wants.

And you heard what he wants in his video clip earlier. He said, “Going back to the gold standard would be hard, but boy, would it be wonderful!”

But now it won’t be hard and he can do just that.

That’s still not the best piece of evidence, though…

Janet Yellen’s Rumored Replacement-in-Waiting

Is a Total Gold Bug

My private dinner near Trump Tower confirmed this for me…

Nothing was explicitly said about who would officially be announced…

But these sorts of things are never really made explicit before they’re officially announced. They’re kept under wraps…

Yet I have enough experience in private meetings to know the subtle hints and connect the dots on my own…

And one of the men I spoke to at that dinner is literally one of the closest people to this potential Fed chair replacement.

I can’t divulge this man’s name for obvious reasons. But suffice it to say you can’t get much closer to the source than him.

He shared a name with me… someone who’s made frequent visits to Trump Tower to speak with the president.

A person that I believe will be the likely candidate President Trump will appoint to replace Janet Yellen as Federal Reserve chair.

Of course, nothing’s official yet, so this isn’t confirmed.

But the White House isn’t going to prematurely mention any of this and risk frenzy...

Yet after a private dinner with a man close to this Federal Reserve candidate… I personally received an important confirmation of this thesis.

And let me tell you…

One economist who has been rumored to soon be in charge of the Fed is a HUGE supporter of gold.

And one of Wall Street’s most respected commentators has backed this potential Trump nominee and also confirmed this replacement-in-waiting is a massive supporter of gold.

I believe a new Federal Reserve chair appointment is a matter of when, not if.

So, when this new chair’s installed…

Trump will have five more Federal Reserve appointments… the full support of Congress… and the rest of the federal and state governments, plus the judiciary, to institute a gold-backed dollar.

The New York Sun confirms the opportunity at hand, reporting:

“President Trump will have a choice opportunity that few if any presidents have had... for monetary reforms needed to end the age of fiat money and… ‘false economy.’”

And Bloomberg proclaimed:

And Politico admitted that “not since Reagan — perhaps earlier — have so many gold bugs had such high levels of influence in the White House.”

Meanwhile, there are three different pieces of legislation already under review in Congress:

One to totally reform how U.S. monetary policy is conducted…

Another to release over a century’s worth of secret Federal Reserve information to the American people…

And a third to create a monetary commission to research the exact monetary changes the Mar-a-Lago Accord would institute.

This is all urgent news for you…

The coming weeks will mark one of the most significant transformations in the international monetary system in over 30 years. Since the dollar is still the lynchpin of this system, the dollar itself will be affected.

Whatever affects the dollar affects you, your portfolio and your personal financial security.

It is vital you understand the changes underway in order to protect your net worth, and even prosper in the coming transition...

Trump’s Dollar “Reboot” Could Mathematically Ensure You Quadruple-Digit Gains

Let me be clear...

The ONLY gold price that will work for Donald Trump’s Mar-a-Lago Accord as I see it is $10,000 per ounce.

This is NOT a made-up number.

This NOT my opinion.

This is NOT complicated.

If they choose more than $10,000 per ounce, we’ll have severe inflation.

And if they choose less than $10,000 per ounce, we’ll have severe deflation.

It needs to be $10,000 per ounce.

That’s a mathematical certainty.

And it can ensure you up to quadruple-digit gains if I’m right.

Go ahead. Check my math...

($26.5 trillion x 40%) ÷ 1 billion oz. of gold = $10,000 per ounce.

It starts with what’s called the “global M1 money supply” — that’s the total amount of money around the world. I believe it will roughly be $26.5 trillion by the time this happens.

Then, I use a 40% gold backing for our money, since that’s what the original Federal Reserve Act passed by Congress mandated.

The next step is easy — just use eighth-grade math…

Take global M1 money supply and multiply it by 40%, our gold backing.

Then take that number, and divide it by the official amount of gold in the world, which is about 33,245 tons or roughly 1 billion ounces of gold.

In the end, you’ll get about $10,000 an ounce.

Now, if the numbers I used fluctuate, that exact $10,000 per ounce may vary slightly.

But the truth is, the gold math is the gold math no matter if the stock markets go up, down or sideways…

To go from today’s price of about $1,300 to $10,000 in 15 minutes would be a 669% revaluation of the dollar.

I’ll admit it’s radical... but we need a radical change.

But suppose I’m wrong and Trump’s Fed decides to do only an 80% reboot to start…

That would still mean that gold would go from under $1,300 today to $5,000 per ounce.

Then, it could do a second reboot from $5,000 to $10,000 per ounce.

My point is, there are a few different ways that Trump’s Fed could reach its potential goals...

The most important thing is to expect it to happen.

But you’re probably thinking...

“I hear you, Jim, and I found this educational... but call me at 2:30 the day before Trump signs the agreement and I’ll go buy some gold.”

And I have two answers for you:

1) You’re going to want one really specific investment (not gold bullion) for the chance to make at least 1,000% from this shift. But you won’t be able to get it at that point.

2) You’re ALSO going to want to own physical gold. But again, if you wait, you won’t be able to get the gold at any price.

The price will take off instantly, but you’ll be standing there watching it gap up on television — going to $2,000, $3,000, $4,000 an ounce — while frantically calling your dealer saying:

“Get me some gold!”

And you know what the dealer is going to say?

“Sorry, we’re sold out.”

Then you’ll try the U.S. Mint and ask again: “Sell me some gold!”

And the clerk will tell you, “Sorry, we’re backordered for the foreseeable future…”

It’s already common for U.S. Silver Eagles to be sold out and on backorder even in relatively calm economic times.

Either way, you’re not going to be able to get your gold or silver when you need it most.

That’s my point.

Get it now, while you can, at a good entry point.

But this is important:

*** DO NOT PUT 100% OF YOUR WEALTH INTO GOLD.

I need to emphasize that because people often misunderstand me and think I recommend putting everything you own in gold.

I don’t.

Instead I recommend you take five very simple steps immediately to prepare for this massive monetary shift that’s coming.

Don’t get me wrong, I support a dollar reboot by President Trump.

But we need to be honest with ourselves.

Just because we may agree with President Trump’s move… doesn’t mean that it will happen with 100% certainty or that the transition will be smooth.

Likely there will be a lot of market volatility once the mainstream media starts reporting on it…

Or once Wall Street gets to react to the fact that the debt party is over.

That’s why the steps I’ve outlined will protect and grow your wealth.

These are steps I’m personally taking with more than $1,000,000 of my own money to prepare for this massive dollar reboot.

So, unlike most pundits who never put their money where their mouth is, we’ll both be in these strategies together…

Step #1:

Position Yourself for 1,000% Gains in the

“Dollar Reboot Composite”

I may be the only person who you’ll hear about this from. I call it the “Dollar Reboot Composite” because it’s the perfect play for this new monetary event.

This little-known investment is not a coin or bar of gold, silver, platinum or palladium.

But it IS a physical precious metal investment.

It’s not a stock, bond, option, ETF, miner, currency or anything else you’ve ever heard of. If you try to find it on Google Finance or Yahoo Finance, you won’t.

You CANNOT buy it in your brokerage account.

And your local bullion dealer WILL NOT know about it either.

And yet it’s extremely easy to buy.

It’s been granted a U.S. patent for its financial innovation…

And it gives you a shot at outperforming gold, silver, platinum and palladium with LESS volatility.

This might be one of my favorite recommendations.

If you read my gold math above closely, you know that the “Mar-a-Lago Accord” would send the price of physical gold up as much as 700% automatically.

But since this little-known “Dollar Reboot Composite” investment outperforms gold, I have strong reason to believe it would rise to at least 1,000% under the scenario I’ve outlined for you.

That’s why I’ve created a complete guide to the coming dollar reboot and this “Dollar Reboot Composite.” The guide’s called 1,000% Gains in the “Dollar Reboot Composite.” It’s yours free when you claim it today.

But that’s not all...

Step #2:

Get 10% of Your Assets in

Precious Metals, the Correct Way

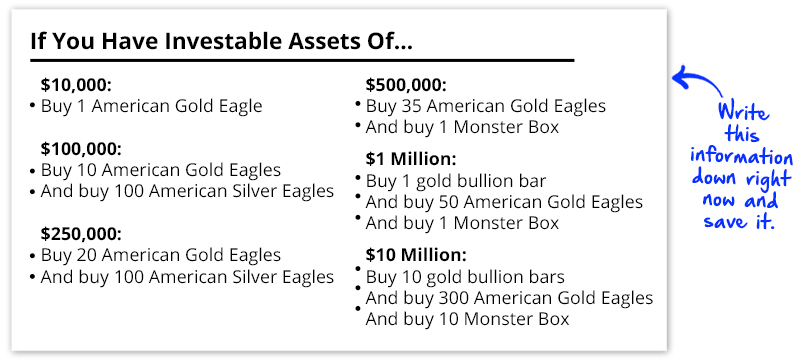

I recommend that every single American immediately put 10% of their investable assets into gold and silver…

Donald Trump himself owns hundreds of ounces worth of physical gold.

So does Trump’s budget chief — along with nearly $1 million in gold investments.

But it pains me to see everyday Americans make simple mistakes when buying gold... or get suckered into buying collectible gold coins.

To avoid any confusion, I’ve created this free handy guide for you:

Make sure to build your allocation with just gold Eagles, Buffalos and bars in the following amounts:

But the truth is, you need to know much more information than this to successfully buy physical gold.

For example, how do you calculate your investable assets?

Do you count your house?

And who do you buy these coins and bars from?

How do you make sure you’re paying the lowest commissions?

And where do you store them?

There are a lot of questions to answer when buying physical gold — and it’s important you get it right.

That’s why I’ve put together a complete guide to answer all of these questions in a free special report that I’ve put together for you called The Perfect Gold Portfolio.

It gives you a road map for buying physical gold no matter if you’re investing $10,000 or $1,000,000.

It also includes access to my proprietary Rickards’ Precious Metals Portal, which gives you a one-click way to order and manage your precious metals.

Keep in mind I’m not selling you gold. These are just my recommended parameters for buying and managing physical gold.

I’ll send it to you free as soon as I hear from you today...

Read the report closely, then, move directly on to taking Step 3…

Step #3:

Develop Donald Trump’s

Ultimate Hard Asset Strategy

Donald Trump’s financial disclosures show that he owns a very peculiar mixture of assets…

On one line item, he has a $100,000-$250,000 asset that, though a drop in the bucket compared to his billions in net worth, says a lot about what Donald Trump believes could happen in the economy.

It could rise roughly eightfold in the coming months…

And end up being his best performing asset in 2017, because he didn’t need to sell before taking the oath of office.

He also has up to $30 million in a very counterintuitive asset…

Once I saw both of Trump’s assets, it reminded me of a two-centuries-old investment strategy that has its roots in Germany — where Trump’s grandfather, Friedrich Trump was from.

I dug up the background to this investment strategy and it did, in fact, reflect Donald Trump’s own strategy.

...As well as billionaire Warren Buffett’s investment strategy…

It’s the strategy of a prominent industrialist and investor with diverse holdings in Germany and abroad during the 1920s.

Few people if any know his name or story.

In many ways, he played a role in Germany similar to the role that Donald Trump or Warren Buffett have played in the U.S.

He was an ultra-wealthy investor whose opinion was eagerly sought on important political matters, who exercised powerful behind-the-scenes influence and who seemed to make all the right moves when it came to playing markets.

He was known as the “Inflation King” because he was able to protect and grow his wealth despite Germany’s massive hyperinflation in the 1920s.

I believe you need to know his strategy by heart and apply it to your own finances.

I’ve detailed everything about him… and how Donald Trump, Warren Buffett and others have used a similar strategy to build their own wealth and what it means for your portfolio.

It’s all in another special report called: Five Secret Investments from the Inflation King.

I’ll send it to you free when I hear from you today.

But there’s something else I recommend...

Step #4:

Become a Shareholder in the

“Deplorables-Only Gold Fund”

This one’s a little bit of fun for me…

A way to fly in the face of the mainstream media, who label anyone a “deplorable” who supports Donald Trump and likes strong borders, a strong economy and a sound, gold-backed dollar...

You see, I’ve uncovered and developed a brand-new gold investment opportunity just for Americans like you.

It also has nothing to do with owning physical gold.

Or tiny penny-stock junior gold miners for that matter.

And it’s not an ETF.

Instead it’s something totally proprietary, tailored to my exact specifications to make the perfect gold speculation.

All you need to access it is…

1) An internet connection…

2) A proprietary link that only we have access to. And...

3) At least $100 to invest.

Of course, we’re not brokers or selling you any investment.

This is all informational. You’ll get all of the steps you need to do this on your own within just minutes.

And yet, because of a technological breakthrough… we are the only ones who can give you access to information about the “Deplorables-Only Gold Fund.”

If you try Googling it, you’ll never find it.

And if you ask your financial advisor about it, he’ll look back at you with a blank stare…

And yet, it could offer you at least twice the return physical gold will give you in a gold bull market.

That means if gold rises by 669% like I showed you it would before… this investment would rise 1,338%!

And that’s WITHOUT any storage risk… or spending anywhere near the price you’d have to pay for even an ounce of gold at today's prices.

I’ll give you access to it all in a free special dossier called: Getting Started With the “Deplorables-Only Gold Fund. ”

It will go perfectly with something else I want to send you...

Step #5:

Master The New Case for Gold Immediately

I’d also like you send you a hardback copy of my best-selling book, The New Case for Gold.

Inside you’ll learn…

- Why I trust only a handful of online bullion dealers. And why most American investors have no idea these trusted, longstanding sources exist. (Page 152.)

- The super-secret, portable asset that’s just as good as gold at storing value. Rich families have used it for centuries. And billionaires like Bill Gates and hedge fund giant Steve Cohen are using it now. (On page 169.)

- I explain why storing your gold at home could be a huge mistake. You don’t want to trust banks or storage units either. The safest option for regular gold holders is the one I name on page 154.

- The #1 gold-buying mistake investors make. You should never EVER buy gold this way... or you’ll put your finances and yourself at serious risk. (Page 165.)

- And much more…

I've poured years of research into writing The New Case for Gold.

I’ve also included a special bonus chapter for you that the general public will never see. It includes five specific gold stock recommendations that won’t just protect your wealth… but grow it when the great gold hoax is exposed.

Again, I’ll send you The New Case for Gold free when I hear from you today…

There’s much more than that, of course.

And if you carefully read and mark up the copy I’ll send you, it will be like you're reading the most confidential plans of the world’s most powerful man... way before they ever go into effect.

Again, the book is yours free when I hear from you.

I’ve put a lot of work into all of this information for you.

But before you tell me where to send all of this information…

I need you to do something for me:

Save the Date:

April 10th, 2018

I’d like to invite you to an exclusive live intelligence session on April 10th, 2018.

It’s online… so you don’t need to deal with the hassle of planning travel or boarding a plane.

There are no expensive hotel rooms to book.

Instead, I’ll send you a private link to access the event online.

You can watch it from the comfort of your home… in your pajamas if you want…

At the event, I will update you on the details of this letter and about President Trump’s potential Federal Reserve appointees…

I’ll reveal how close the “dollar reboot” is to being complete...

Or what’s coming next if the reboot already happens by the time we hold this session.

If there are any tweaks or improvements in the plan that you should know about...

And I'll also be answering questions... live.

Please, just keep in mind I can’t give personalized investment advice. But I'll tell you about the latest developments in this story and how you should prepare.

Tickets to an event like this would normally cost a small fortune…

I normally charge $25,000 or more to speak at investment conferences.

But today you have the chance to join me in this live event… all free.

And that’s just the beginning of what I want to send you...

You see, as Chief Global Macro Strategist at Agora Financial — an independent forecasting firm based in Baltimore — I produce the world’s premier financial research service.

It’s called Jim Rickards’ Strategic Intelligence...

From the Highest Levels of Government, Wall Street and Global Capitals to Your Inbox

100,000 around the world consider my Jim Rickards’ Strategic Intelligence network their eyes and ears in the world of elite finance and politics…

My work takes me across the globe and allows me to leverage my network of high-profile contacts in Wall Street, the intelligence community and the highest levels of government.

Yet even though I constantly appear on everything from CNBC to Fox and CNN, there’s been a serious problem…

Those venues don’t allow me to share my most sensitive moneymaking moves.

And that’s important, because today we stand at the critical moment…

Either Donald Trump will succeed, and there are tremendous opportunities for you as an American and investor…

Or he’s foiled by all the career politicians and other “swamp creatures” in Washington, D.C., in which case, you’re going need a financial and personal backup plan.

Things are volatile. The market will change very quickly… so it’s best you have the latest information in any event.

I've been looking for a venue where I could help my readers on an ongoing basis as this critical moment in history unfolds, recommending where to invest and how to avoid the pitfalls.

That’s why I decided to launch Jim Rickards’ Strategic Intelligence.

My mission in this letter is to help people prepare for financial threats and capitalize on financial opportunities.

I want you to avoid the kind of financial heartache my family and I experienced firsthand, twice…

And to learn from my decades of building back up a financial fortune of my own.

In this monthly publication, I'll write directly to you, keeping you up to date on how President Trump’s new monetary accord may be unfolding...

I’ll keep you up to date about the market’s current trajectory...

And give you specific investment recommendations and wealth-protection strategies that will help you grow your wealth even during the meltdown.

Until recently, I have only provided this kind of service to my high-net-worth clients and members of the U.S. intelligence community.

But with Rickards’ Strategic Intelligence, you too will have the opportunity to hear my best ideas on an ongoing basis.

And it’s important to note, this will be the exclusive place to receive my monthly issues and alerts.

This newsletter will not be available anywhere else in the world, at any price.

I strongly suggest you claim the free reports I told you about above.

Because, there isn’t much time left to prepare for Trump’s dollar reboot.

It could come sooner than I’ve outlined for you today. All it would take is another resignation from a Federal Reserve board member to speed up this timeline. And we’ve already gotten one surprise resignation this year already.

The time to act is now.

Since you’ve read my letter this far, I’m confident you’ll do the smart and prudent thing…

Now’s the time. I sincerely hope you’ll join me.

Click the “Claim Now” button below to go to your claim form — where you’ll be able to read and review everything that comes with your subscription today.

Your Complete Mar-a-Lago

Accord Reboot Package

And as soon as you agree to take a trial subscription of my Jim Rickards’ Strategic Intelligence newsletter today, I’ll send you…

Report #1: The Perfect Gold Portfolio

Report #2: 1,000% Gains in the “Dollar Reboot Composite”

Report #3: Five Secrets from the Inflation King

Report #4: Getting Started With the “Deplorables-Only Gold Fund. ”

…Plus a hardback copy of my best-selling book, The New Case for Gold, sent directly to your doorstep.

I want to put it in your hands as quickly as humanly possible when I hear from you today.

Then, each month, I’ll also send you the members-only Jim Rickards’ Strategic Intelligencenewsletter, along with updates and actionable investment recommendations.

You’ll get the first word from me on the research I gather from all of my contacts in intelligence, government and finance, and urgent news and updates on the special reports... the monthly plays... and protection strategies.

As part of my elite intelligence research network you’ll also receive:

FREE Monthly Intelligence Briefing Webinars: Just like the briefing I’m inviting you to on October 17, I hold these interactive briefings every month. Keep in mind, I can’t give personalized investment advice on the calls… but I can and do answer your questions about what’s about to happen in the markets and the economy.

How much does this strategic intelligence cost you?

The published price of a one-year membership to Rickards’ Strategic Intelligence would run you $100 per year.

You see, my research network employs a former managing director of Goldman Sachs… a former hedge fund powerhouse... a retired naval officer who worked at the highest levels of the military... the former ranking defense executive in the Middle East who speaks Russian and Arabic... a former presidential candidate’s aide and more...

We publish our findings in over eight countries and in four different languages.

That’s why over 100,000 readers worldwide consider us their “Personal CIA” for staying informed and making decisions:

Excellent big-picture view of what is happening in the world, back up by extensive contacts with actual movers and shakers

– Frank G., St Louis, MO

I’m finally free from so-called “financial advisors” who seem more interested in padding their own wallets at my expense than offering advice that can steer me and my family toward financial independence and self-sufficiency

– J. Johnson, Long Beach, CA

Other readers might point to monetary gains and portfolio diversification, but in my case the most valuable and appreciated gift I have drawn from your recommendations and letters is peace of mind and a better sleep. After 2008 I felt like I was walking through a haunted house for the first time, trying to brace for every turn, in an attempt to suppress the jolt of surprise. You remember… that naked ominous feeling that you know if inevitable but you can’t do anything to stop. I would put my head on my pillow every evening feeling that way, wondering if I was going to wake up and have to start from zero again. I now feel more secure financially as a provider for my family. That one is the greatest gift one man can give another in my honest opinion.

– Mike W., Poughkeepsie, NY

I have yet to find any other financial publication that speaks the truth like this.

–Dave M., Hillsboro, IL

I have found politics is having a greater effect on investments than economics… now I benefit from that knowledge.

– T. Patron, Roanoke, VA

Collectively, we spend $3 million annually to publish the boldest forecasts and information about the international monetary system… government policies… and steps you can take to protect and grow your wealth.

Yet, despite the time and money we put into this project, we’re able to keep the annual price to an amazing rate of just $100 using the internet and new publishing technology.

But for a short time, you can access my research advisory for just half the price of the usual rate. You'll pay only $49 for one year.

How can I manage to give my analysis and proprietary strategies for so little?

The truth is, I’m not interested in money...

I’ve made my money during my career and have retired.

Since retiring, though, I’ve spent more than a decade working to get the word out about the threats facing America...

Through my best-selling books… and speeches and TV interviews... I’ve tried to warn Americans and — god willing — convince enough people to change the nation’s course.

But recently, I realized that the progress I was making was too slow. I needed to bring my strategies and continuing analysis straight to everyday Americans like you.

If you think I’m feeding you a load of bologna — here’s what I’ll do to prove to you I’m not.

Today, I’ll let you take a risk-free test drive of Rickards’ Strategic Intelligence for the next 365 days — a full year.

You can read every piece of strategic intelligence I’ve published… my monthly issues… my free reports… my live intelligence briefings and more.

That way you’ll see if my strategies, research and opportunities to grow your wealth are the real deal.

Essentially, I want to take as much risk as possible away from you in order to get my research advisory service in as many Americans’ hands as possible.

If you decide for any reason my work is not right for you, just let me know and you can receive a full refund... and keep everything you've received so far.

To be clear, I’d only like you to agree to TRY Rickards’ Strategic Intelligence today with no strings attached.

When you do, I’ll sweeten the pot by adding a hardback copy of my book, The Big Drop. But only if you take advantage of my offer right here and now.

Inside you’ll learn…

- How to (almost) instantly judge the safety of your bank. Plus, a comparison of local community banks, mega-banks, and credit unions (if you keep any cash at all in your bank account, please read this).

- The financial warfare plan that could bring the United States to its knees (the real story is how it affects you and your savings if you own any traditional investments like stocks & bonds).

- Why you should NOT worry about whether we will have inflation or deflation (and what to do instead that will safeguard your money—and earn a nice return—no matter what happens)

- What you should know about the price of oil and why it’s not always better to pay less money at the pump (surprising but true!)

- The former Treasury Secretary of the United States and his plan to have the Government simply deduct the money they want from your bank account every month. The top 20 biggest governments on earth—including the United States—are seriously considering this strategy as a way to deal with their debt.v

- What you should know about Warren Buffett and how he seems to be betting against the dollar, even though, his company Berkshire Hathaway holds over $50 Billion in cash. He seems like the all American success story who is rooting for US stocks, but what he is actually investing in tells a different story.

- One investment that gives you physical ownership of gold, silver, platinum and palladium all in one (The best part? It gives you higher returns with less volatility than if you owned all the metals individually)

- What you must know about the risks of holding a large portfolio of stocks (Stocks could drop by 3,000 points or even more and recommends you do this to protect yourself).

- And much, MUCH MORE ...

I've poured years of research into writing The Big Drop. It gives the intellectual basis for this coming dollar “reboot.”

We do not sell this book through Amazon or through any brick-and-mortar bookstore. This is the ONLY place I distribute this rare and valuable book.

Again, I’ll send you a hardcopy of The Big Drop free when I hear from you today…

' 시사 * 경제' 카테고리의 다른 글

| [스크랩] 알려지지 않은 한국의 군사력 확대, 원자력 잠수함 건조 추진, 높은 핵개발 능력보유 (0) | 2018.03.12 |

|---|---|

| [스크랩] 트럼프의 무역전쟁은 패권포기책 (0) | 2018.03.05 |

| [스크랩] 반복되는 경제붕괴 패턴 (0) | 2018.03.05 |

| [스크랩] 독재와 패권을 강화하는 시진핑 (0) | 2018.03.02 |

| [스크랩] 상승하는 금리는 지불불능을 전망- Michael Pento (0) | 2018.02.24 |